Earnings Based Models for Valuing Gold and other Resource Stocks

I use an earnings based valuation model to obtain estimates of underlying business value to assist in finding companies for investment at prices significantly less than their value . As a shareholder of a business, you generally want good return on your capital, low dilution of your shares, and growing profitability with strong incremental return on reinvested profits. Some people like dividends, but I think that it is a personal preference. Generally high levels of profits being paid out in the form of dividends means that there are few profitable opportunities to reinvest profits back in to the business.

I believe that to be successful over long periods of time the trick is to be able to see where earnings are headed and to find the big trends. I think that it is also appropriate to use an earnings based method for valuing producing resource companies, which goes against what others believe. Many consider EV/Resources or EV/Reserves a good way to compare companies and determine relative value. However for me this doesn't make a lot of sense. I'm not saying it doesn't work, but it doesn't fit within my view of how the world works. I'll explain.

As an investor, I can choose to put my capital at risk if I expect that I can derive a rate of return greater than the risk involved. This return can be in the form of profits that are reinvested back in to the business or as a return of capital via dividend or other form. This is the key point. I need to have a certain rate of business revenue, less cost of operating the business, to derive a profit. You can put this down as a stock versus flow argument.

"A bird in the hand is worth two in the bush"

If I invest in a producing mining company my intent is profits. I want the proverbial bird in my hand and not left out in the bush. I'd also like it sooner rather than later, you know, the whole time value of money concept. In a cyclical commodity cycle and long term gold bull market, I definitely want the stuff in the hand.

Why is this? A bar of gold in the hand is worth more than nuggets in the ground. The reason for this is two-fold. Firstly, the gold in the hand is de-risked, whilst the gold in the ground may have difficulties with extraction and price of extraction may increase due to rising fuel costs, labour costs and so on. Secondly, the gold in the hand has optionality. It can be stored and utilised at any time. It can be sold and used to transact and acquire another business, it can be used to acquire new tenements which have known reserves or for greenfield exploration. It can be used to pay dividends, buy back shares, pay down debt.

This leads us to the flow argument. A producing mining company has flow as well as stock, while an explorer has only stock. Things change: commodity prices change, regulations change, governments change... you get the point. If you can get the flow out of the ground as quickly as possible at the lowest possible cost, you have something of real value. If you cannot get the flow out of the ground as quickly as possible and the cost is unknown, or at worst uneconomical, you have a potential liability on your hands. The former is desirable whilst the latter leads to capital raising in the form of more shares or more debt. When investing in mining companies, I'm actually investing in the flow and not the stock.

But what about the mine life, you may ask. Surely if the mine life is expected to be short this is a bad thing, right? Well, given the value of flow over stock, this isn't as great a concern for me. If I'm investing in a company which is focusing on getting the metals out of the ground quickly, with low cost, profitable, strong cash flows and a demonstrated ability to do what they say they will do, what would stop them from purchasing another company that has less effective management or further tenements with known reserves that they are able to economically extract? This is the business side of the operations that I think is under-appreciated compared to the reserves. As with all businesses, effective management can lead to great things whilst valuable resources can be ruined with poor management. This is the key and this is why I value the flow of production over stock in the ground. From this point of view, you don't need to worry about the fact that individual resources are not infinite.

Example: Ramelius Resources

Ramelius Resources is a company that I currently invest in based on profitability, cash flow, management and growth profile. There is some concern that the existing mine called Wattle Dam has a limited mine life. Wattle dam has the highest grade and is one of the lowest cost gold mines in Australia. Well, somehow they 'found' another 2.5 years in mine production this year. They have mined at 360m depth thus far in a region which is has had resources up to 1km depth (not suggesting here that Wattle Dam is necessarily this deep). Oh, and the 2.5 years additional mine life has resulted from ore found within the existing 360m depth.

Perhaps the gold stops at 360m. Perhaps it goes to 500m and the mine has another 5-6 years. I'm not even worried about 10 years life because gold is the place to be over the next 5 years, but who knows what will happen in 10 years? If all else fails, they will have significant cash flow and relatively higher share prices which can be used for the right acquisitions. If I believe that the management are effective then I can do nothing else but trust that they are thinking about these issues. If it is clear that they are not, I'm not going to hold shares in a company which has otherwise good resources but ineffective management.

When investing for the flow, you generally don't want over-drilling to define the resources at the nth degree. If you trust that management have a good feel for the resource, this is a superfluous use of capital and takes away from profitability. I believe that it is great for geologists but bad for investors.

The way I see it is that as an investor I can generally get the feel that management are taking the right actions. If they are profitable, growing in profitability, have strong cash flows then I'm going to leave it to their expertise (especially since I don't know enough about geology). I believe that my expertise lies in deciding on the right areas to invest, the companies which demonstrate significant value within these sectors and ensuring that management is doing what they say they will do.

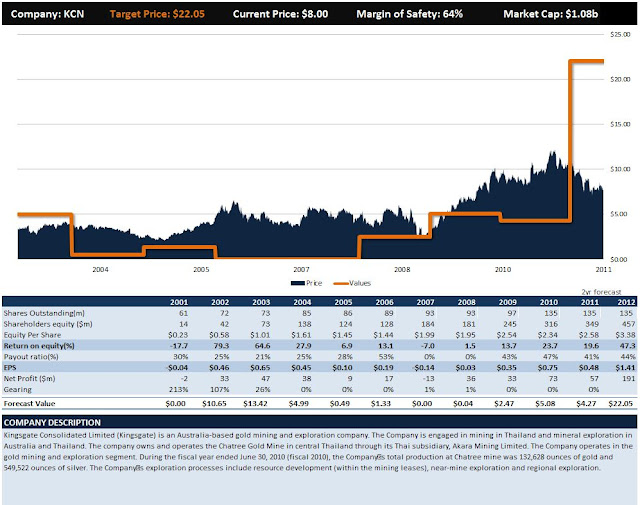

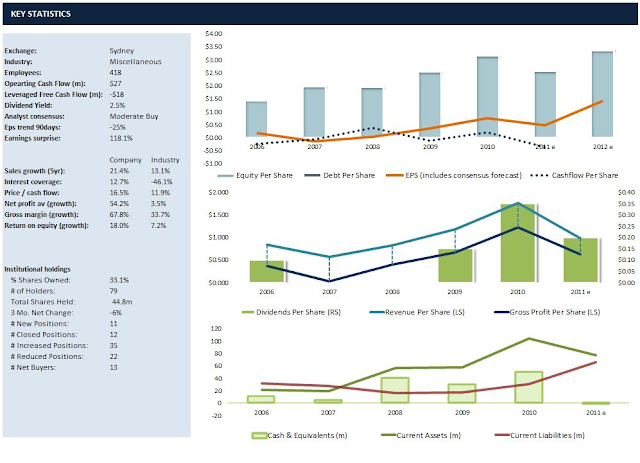

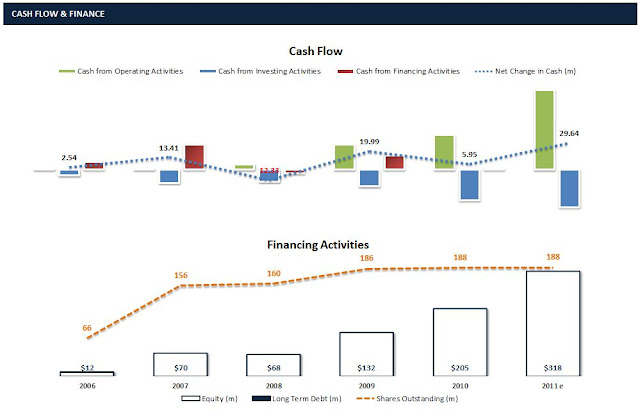

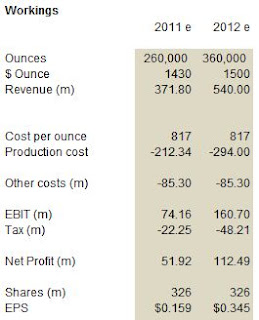

Valuation Examples

Perhaps what I've said so far makes sense, but an argument could be made that it doesn't work in practice. That is, the values from an earnings based (flow) model do not help with actual investment decisions compared to resource based models (stock). Here are a few cases.

Atlas Iron

Although I don't invest in this company because I don't like the current macro factors in the iron ore market, this is a great company that is only just become exceptionally profitable this year. Look at what happened in 2007/08, before it was making money. It fell in to the ground. Yes, it rebounded, but it didn't have the profits or the cash flow backing for its value. I looked at AGO last year (2010) and could have invested at $2 per share with a good margin of safety. Without my concerns about the iron ore market, I would have.

BHP

BHP has a long track record of profitability and is an icon in the industry. It is a diversified miner and very well represents investing based on flow. They have massive cash flow which allows them to make very shrewd and well-timed acquisitions. This is a case of investing in a business as opposed to a resource.

Santos

You would think that in a strong oil and gas market, oil and gas companies would be more profitable. Not necessarily so it seems! Santos has been able to generate return on equity figures between 5-8%pa which is very poor. This company has experienced declining profitability and the share price hasn't gone anywhere since 2005.

Woodside

Similar to Santos and also in the oil and gas sector, Woodside was very profitable in the past but also has had declining profitability in recent years. Unless the Pluto gas expansion plans continue to experience delays, it should get back to form over the next couple of years.