The NASDAQ index value is losing momentum. Is a correction possible? Certainly, however at this stage it remains stronger than S&P500 and Dow Jones - perhaps the least dirty shirt of the three.

Wednesday, 12 June 2013

Tuesday, 11 June 2013

Tuesday, 4 June 2013

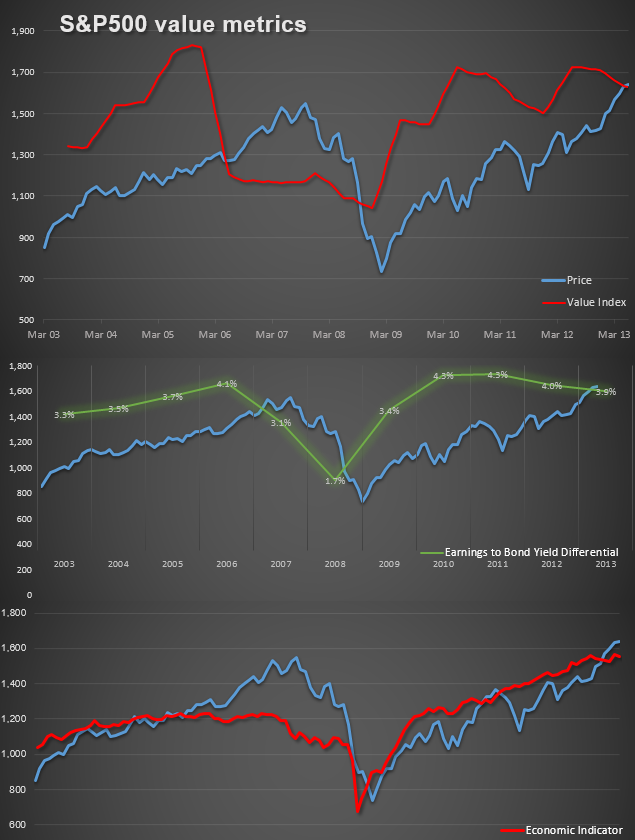

S&P500 Valuation: Downside Risk

In recent periods, the S&P500 has exceeded value targets. Combined with the fact that there is a downward trend in the metrics, there is an implied strong possibility for a correction in the near term.

Monday, 3 June 2013

Aussie Banks Valuation

All the major Aussie banks (CBA, WBC, ANZ, NAB) appear to have reached and surpassed full value. Without any changes to the underlying metrics and earnings momentum, we could see a reasonable price correction. Any deterioration in bank profits is likely to feed straight through to share price declines.

2012 ASX Forecast: Review

It took a bit longer to head above 5000 than expected, but the forecast made in Jan 2012 was very accurate.

Sunday, 2 June 2013

Dow Value Update 2013: Value is Priced In - 15% Correction Possible

In my 2012 equity outlook this is what I said:

"Fair value is trending up strongly, with the Dow Jones still appearing cheap, and is highly likely to indicate a continued equity market rally from here."

This is the first update since early 2012.

All three metrics suggest that the Dow and, by association, the US equity markets are fully priced and have the potential for a correction. Whilst the current circumstances do not yet appear to be any where near 2008 levels, I would suggest that a 15% correction is definitely possible. This would imply a price target of just under 13,000 from the current level of 15,115.

Timing is uncertain, but a move to between 13,000 [-14%] to 14,000 [-7.3%] is highly possible between now and the next three months.

Caution at this point.

Note that current value metrics are still being updated from 2012 and may be adjusted or improved.

Subscribe to:

Comments (Atom)