Mt Gibson Iron - Macro Value Analysis

Speculative Higher-Risk Value Momentum Strategy

I've been negative on iron ore prices and producers for some time. But one must move with the times and avoid being beholden to a single view. In line with the risk-on theme and the bullish potential for the markets in 2012 - at least in the first half of the year. What comes after this is something that will need to be watched closely, in particular oil prices. As seen below, my macro market indicator is confirming that it is time to be risk on. MGX is one of my positions to capture this move with an entry price of $1.18.

1 year share price

I realise that it is in a technical down-trend, however I'm calling a turn-around here.

The potential value already exists, however the macro trends have been against this stock. Given my view of a turn-around in the markets, I think that the price can now move towards value again. All the figures stack up for me:

- Broad macro trend is in now in the right direction

- Substantial value based on earnings expectations

- Strong uplifts in earnings per share forecast

- Stabilisation of recent EPS forecast declines

- Trend up in iron ore prices

- Consistently increasing forecast earnings per share matched by operating cash flow

- Strong uplifts expected in revenue per share

- Growing and solid margins

- Solid cash liquidity and with growing cash generation likely to turn in to excess cash

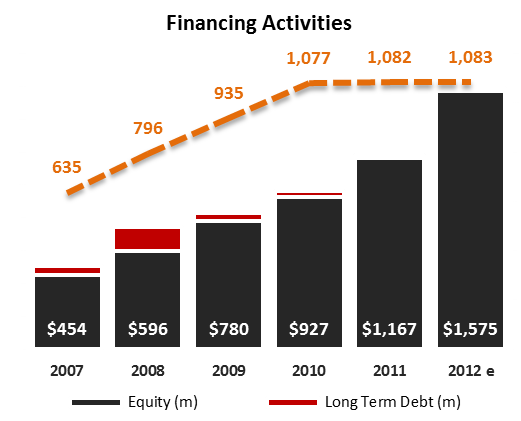

- Stable amount of total shares outstanding and no debt

And Iron Ore prices courtesy of Deus Forex Machina from macrobusiness.com.au:

Nows an excellent time to get into iron ore stocks the thing that steel is made from. Steel stocks have taken a dive over the last couple of years.

ReplyDelete